The Patent Box Regime Rules, implemented through Legal Notice 208 of 2019, apply to income derived from qualifying intellectual property on or after the 1st of January 2019.

A qualifying Intellectual Property (IP) is a patent which could either be already approved and issued or is awaiting approval. It can also be an asset towards which protection rights have been granted in terms of national, European or International legislation or utility models or software protected by copyright under national or international legislation.

With respect to small entities, these regulations still apply to intellectual property assets which are innovative but having features similar to those of patents. Entitlement to the deduction under these rules shall be applicable if a number of conditions are satisfied. For a full list of such conditions, kindly read our updates on our website.

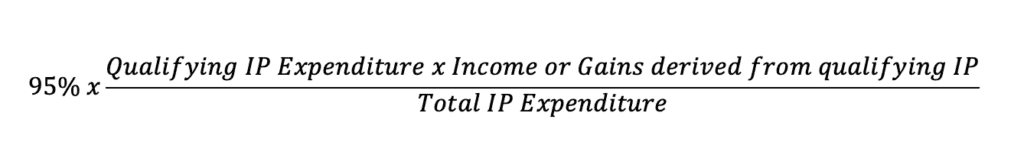

The available deduction under this regime is arrived at by using the following formula;

The total income or gains shall be the income directly derived from the use, enjoyment and employment of the qualifying IP. The Total IP Expenditure shall include all expenses directly incurred in the acquisition, creation, development, improvement or protection of the qualifying IP.

As for qualifying IP Expenditure, one needs to include the expenses for the creation, development, improvement or protection of the IP that are:

a) directly incurred by the beneficiary or

b) subcontracted to persons not related to the beneficiary.

With respect to expenses incurred which do not fall within the above definition, an amount equal to the lower of the costs actually incurred or thirty percent (30%) of the total costs referred in a) and b) above can be taken into account.

For further information regarding the Patent Box Regime, kindly read our updates on our website.