As we usher in the new year, businesses need to stay informed about the latest updates in payroll, employment, and related regulations. In this comprehensive overview, we’ll delve into the significant changes for 2024, covering crucial aspects such as the Cost-of-Living Adjustment (COLA), Minimum Wage, Leave Entitlements, Income Tax Rates, and Social Security Contributions.

COLA

2024 sees the Cost-of-Living Adjustment with an increase of €12.81 gross per week (€666.12 gross per annum) for full-time employees. This adjustment is prorated for reduced working hours, translating to €0.32 per hour for part-time employees based on a standard 40-hour week.

Source: LN 388 of 2023

Minimum Wage

Effective January 1, 2024, the national minimum weekly wage for full-time employees varies based on age:

- 18 years of age and over: €213.54

- 17 years of age: €206.76

- Under 17 years of age: €203.92

- Part-time employees’ minimum wage should be calculated pro-rata at the same hourly rate as comparable full-time employees.

Source: LN 287 of 2023

Vacation Leave Entitlement

In 2024, a full-time employee with a 40-hour workweek is entitled to 240 hours of paid vacation leave. This includes the basic 192 hours leave entitlement plus an additional 48 hours in lieu of public holidays falling on weekends, adding up to a total of 30 days of paid vacation leave. The entitlement is pro-rated for reduced working hours.

Source: S.L.452.87

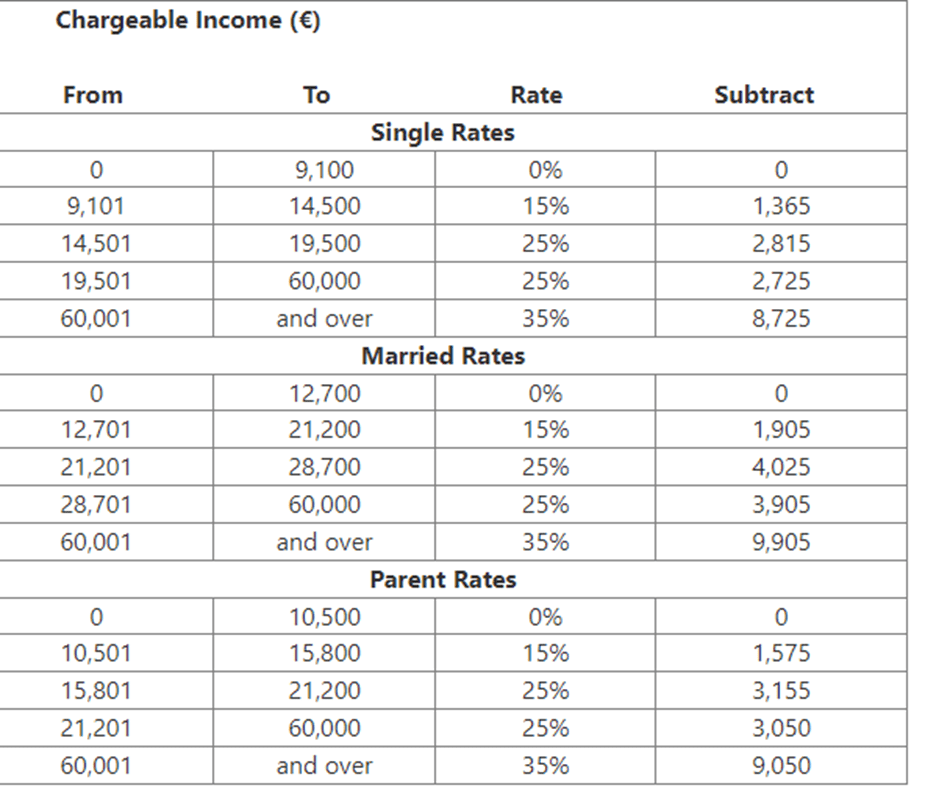

Income Tax Rates for 2024

The following table outlines the structured tax rates applicable to chargeable income for the calendar year 2024:

Source: Tax Rates 2024

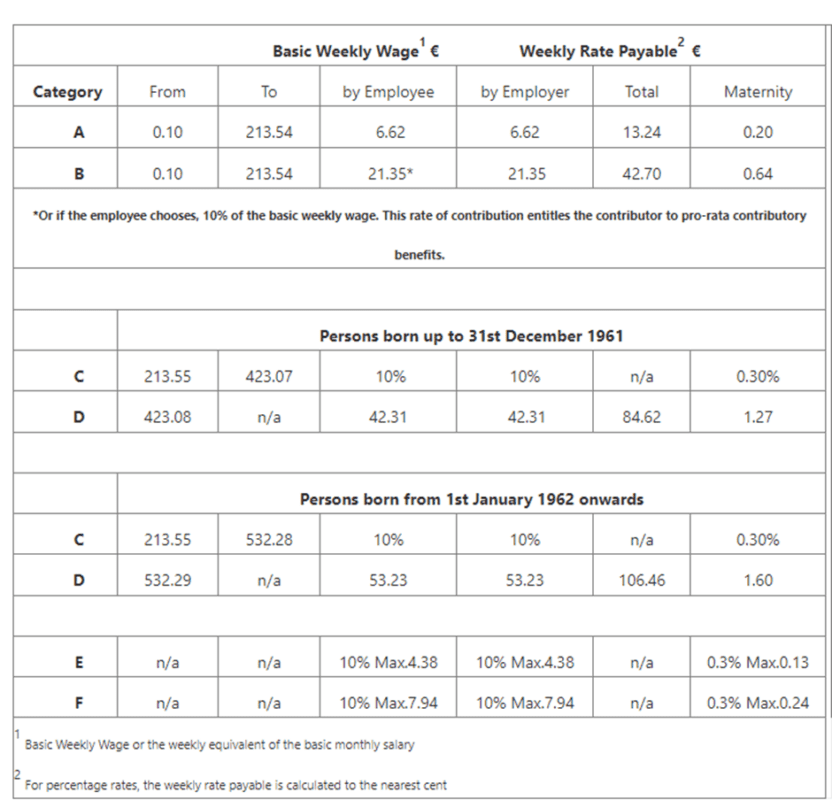

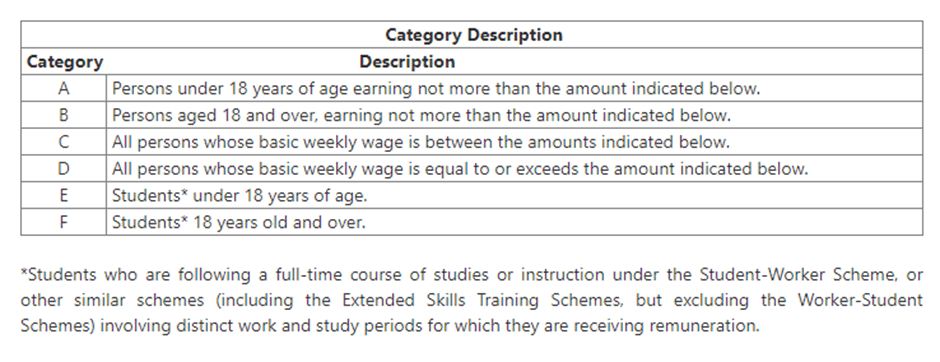

Social Security Contributions

The table below outlines the Social Security Contributions and Maternity Trust Fund Contributions applicable to Class One (Employed) Persons, effective from January 1, 2024:

Source: Class 1 Social Security Contributions

If you need any help or assistance with the above-mentioned, please do not hesitate to contact us on [email protected].