Our Services

The Maltese Citizenship by Direct Investment

The Maltese Citizenship by Naturalisation for Exceptional Services by Direct Investment (ESDI)

By virtue of Legal Notice 437 of 2020, the granting of Maltese Citizenship by Naturalisation for Exceptional Services by Direct Investment (ESDI), as regulated by the Maltese Citizenship Act (CAP. 188), has been recently introduced in Malta.

These regulations allow individuals and family dependants to acquire Maltese citizenship, and by extension a Maltese Passport, by making a direct investment in the country, which investment is always subject to a very strict due diligence process, including but not limited to very meticulous background checks of the individual applicants.

Liana Falzon

Manager - Private Clients (Residence & Citizenship)

Who can apply?

Any individual and his dependents may apply fpr Maltese citizenship under these regulations, as long as they are commited towards a direct investment in the country.

The qualifying dependents as defined by the above-mentioned Legal Notice are:

- The spouse in a monogamous marriage. Life partners, including a civil union, domestic partnership, common law marriage also qualify. The term “spouse” in these regulations is to be understood as being gender-neutral;

- Children of the main applicant or of his dependent, including adopted children, who are under 18 years of age at the time of submission of application;

- Children of the main applicant or of his dependent, including adopted children, who have turned 18 but have not yet turned 29, at the time of submission of application. These children should be able to prove that they are not married and that they are financially dependent on the main applicant;

- Children of the main applicant or of his dependent, including adopted children, who at the time of submission of application have turned 18, and are qualified as persons with a disability;

- parents or grandparents of the main applicant or of his dependent over the age of 55, at the time of submission of application, who are not married and who can prove that they are financially dependent on the main applicant.

How to apply?

There are three main steps one must satisfy before being granted Maltese citizenship under these regulations:

1. Application for Maltese residency – one of the requirements of these regulations is that an applicant and all adult dependants must hold a Maltese residence card for a minimum of 36 months or by exception for a minimum of 12 months. Applicants who are already in possession of a Maltese residence card will automatically proceed to point (2) hereunder. If an application is submitted correctly to the Agency, it takes around 15 working days for the card to be issued;

2. Application for eligibility assessment – this should be submitted within 12 months from the issuance of the residency card; and finally

3. Application for Maltese Citizenship by Naturalisation for Exceptional Services by Direct Investment (ESDI) – as per point (1) above, applicants may opt to obtain citizenship either after 3 years or after 12 months. In each case, submissions should be made after the expiration of the respective residency periods.

The direct investments linked to point (3) above are the following:

- A Government Contribution: The applicant has the obligation to pay a contribution to the Maltese Government, before being granted Maltese citizenship, which can vary as follows:

- Procedure 1: If applying after 36 months of residency in Malta, a contribution of €600,000 is due for the Main Applicant and €50,000 for every additional dependant;

- Procedure 2: If applying after 12 months of residency in Malta, a contribution of €750,000 is due for the Main Applicant and €50,000 for every additional dependant.

- A Property Investment: The applicant may either buy an immovable property in Malta with a minimum value of €700,000. Alternatively, he may lease one for a minimum annual rent of €16,000. In both cases, the immovable property needs to be retained for at least five years from the date of issuance of the certificate of citizenship;

- A Donation: The applicant is obliged to give a donation of €10,000 (minimum), prior to the issuance of the certificate of citizenship to a registered philanthropic, cultural, sport, scientific, animal welfare or artistic non governmental organisation or society.

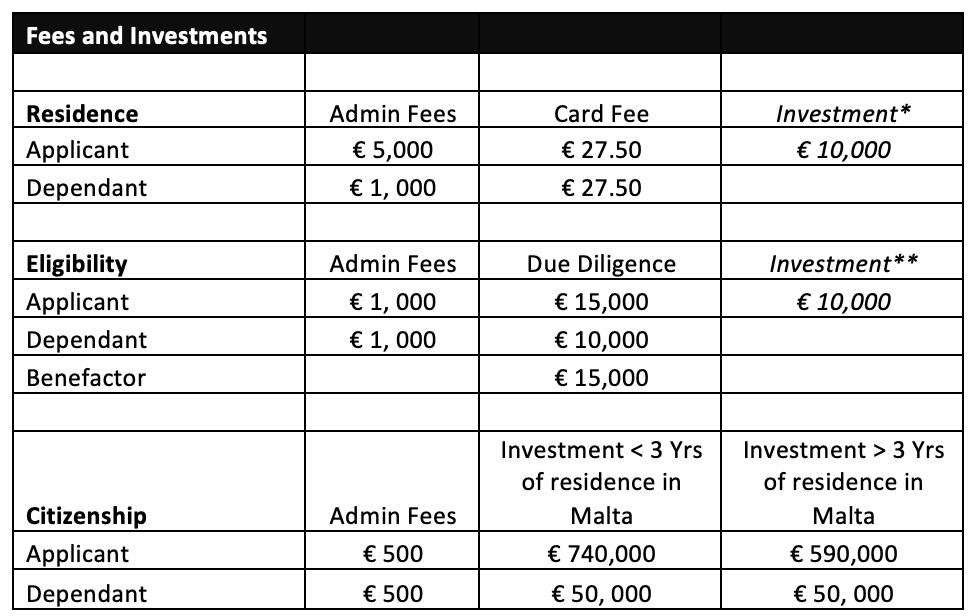

Processing fees

Apart from the above qualifying investment criteria, applicants are required to pay the following due diligence fees to the Government Agency:

* Part payment of non-refundable deposit

** Non-refundable deposit of the investment re: donation to a registered philanthropic, cultural, sport, scientific, animal welfare or artistic non-governmental organisation or society, or as otherwise approved by the Agency

The number of certificates by Maltese Citizenship by Naturalisation for Exceptional Services by Direct Investment granted, excluding dependants, has been currently capped at 1,500.

Our firm is in a position to assist you with the compilation and submission of the documentation required for such an application. For further information and a tailor-made quote, please contact Stephen Balzan, one of the firm’s partners, on [email protected], or Liana Falzon, who is the manager in charge of the firm’s private clients on [email protected].

TAX ADVISORY sERVICES

ACT is a well-known and respected boutique tax advisory firm providing high-quality tax advice to Multinational Enterprises, SMEs including family owned and other owner-manged companies, family offices, trusts, foundations, employees and high net worth individuals.

Corporate Taxation in Malta

Maltese companies are subject to tax at the rate of 35% on their worldwide income and capital gains. Malta grants various fiscal incentives to both companies and their shareholders upon the distribution of a dividend.

Setting up a Company in Malta

Setting up a company in Malta is a relatively straight forward procedure and can be set up within 2 working days, provided we are in receipt of all the information, funds and due diligence documentation we need.

Taking up Residence in Malta

Remote Gaming in Malta

Payment Institutions in Malta

Electronic Money Institutions in Malta

Malta has recently seen an increase in the number of Electronic Money Institutions (EMIs) looking to set up their operations in Malta. This has been largely due to the growth in the e-commerce and the i-gaming industries.