Introduced by means of Legal Notice 258 of 2020, such rules apply to income derived on or after 1st January 2020 from a private residential lease. Such lease must be of a duration of at least 2 years and is registered with the Housing Authority as a long private residential lease. For the purposes of these regulations, the duration of the lease refers to the original period agreed in the lease contract and does not include renewal or extension of such original period.

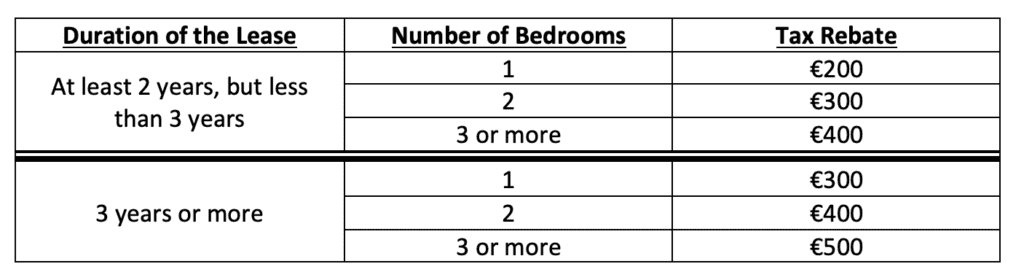

The tax rebate granted under these rules applies where the rental income derived from the above mentioned lease is subject to withholding tax of 15% on the gross rental income. The amount of tax rebate depends on the duration of the lease and the number of bedrooms, as per the following table:

The above tax rebate applies for every year of the lease and with respect to those years in which the lease commences or is terminated, the amount of tax rebate shall be calculated pro rata. The tax rebate cannot exceed the amount of tax due on such rental income for that respective year.